The Free Application for Federal Student Aid (FAFSA) is open!

We understand that the changes to the 2024-2025 FAFSA may have made the filing process challenging for you and your family. You can still file your FAFSA and we are here to support you!

If you experience any technical issues when filing, make sure to reach out to the FAFSA Help Center.

UTK students need to complete their FAFSA every year to apply for or remain eligible for most types of aid, including state and federal grants, need-based scholarships, Federal Work-Study, the HOPE scholarship, loans, and more!

Your FAFSA Next Steps

I’ve Filed the FAFSA

UT will start preparing admitted and new transfer student financial aid offers at the end of the week of April 15-19. If you filed your FAFSA and no corrections are needed, you will receive a digital financial aid offer at the end of that week in your UT email account!

UT will prepare current student financial aid offers in June, after all spring semester grades have posted.

FAFSA Corrections Needed If you filed your FAFSA and corrections are needed*, please log in to your Federal Student Aid Account (FSA) to see what corrections are necessary. As soon as you make and submit those corrections, FSA will reprocess your FAFSA. Once UT receives your updated FAFSA, we will package you as soon as possible! *Note: some corrections must be made by the Department of Education, not by students and families. You will receive an email if your FAFSA must be reprocessed by the Department of Education (this will not require any action on your part). Reprocessing by the Department of Education will begin after May 1. We will send you a financial aid package as soon as we receive your updated FAFSA! We will prepare your financial aid package as soon as we receive your updated FAFSA, so keep an eye on your email inbox! Provisionally Independent and Unusual Circumstance Appeal Many students who select “provisionally independent” on their FAFSA do so unintentionally. If you made this selection on your FAFSA and need to make a correction, please log in to your FSA account and make these updates. If you have special circumstances that apply to you, you can appeal for unusual circumstances. Learn more about the appeal criteria on our webpage at onestop.utk.edu/financial-aid/appeals/. Please contact One Stop from your UT email to explain your situation and begin the appeal process. Only Unsubsidized Loans If you indicated on your FAFSA that you only want to be considered for unsubsidized loans, this means your parent/guardian information was not included and you are not being considered for your full financial aid. To make sure you are considered for all of the federal aid you are entitled to, make sure you remove your selection for “only unsubsidized loans”. Log in now to your FSA account and follow the instructions to make corrections to your FAFSA. After you submit your revised FAFSA, it will go through the review process again. We’ll send you an email to let you know when we’ve received your FAFSA and when your financial aid package is ready for you to view.

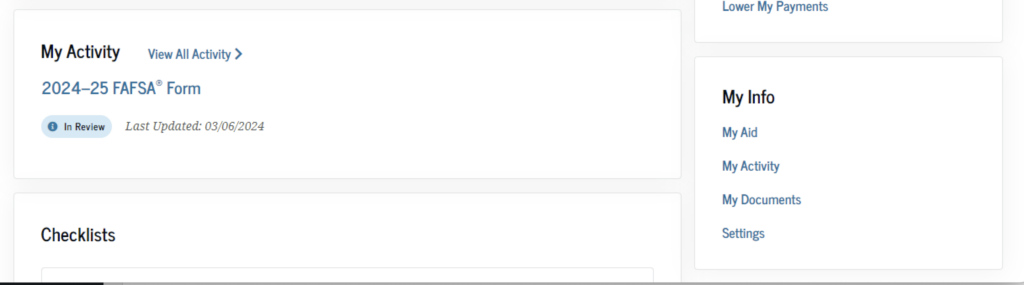

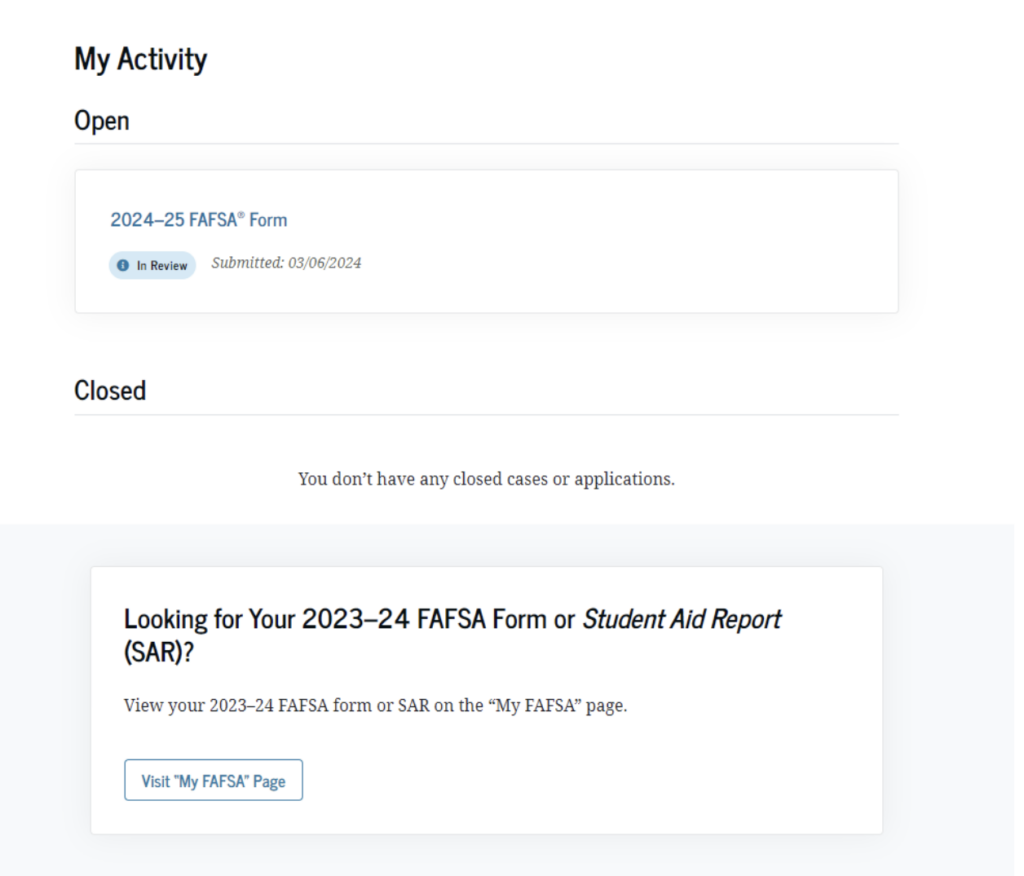

Click on the “My Activity” section. On this page you can see your Open and Closed cases and applications. Under “Open” at the top of the page, you’ll see your 2024-2025 FAFSA Form listed. Underneath the title of that form you’ll see your Status Review and submission date. You can click on your FAFSA Application to see the Status Tracker and get a detailed view of your status updates. You can keep an eye on this page to find out when your FAFSA has been processed!

![]()

You can learn more about other status updates by viewing the Student Aid FAFSA Submission Summary Page.

I Have Not Filed the FAFSA Yet

If you have not yet filed your FAFSA, you still have time! You and your parent(s)/guardian(s) will need to use individual FSA IDs to file the FAFSA.

- Make sure you and your parent/guardian have your FSA IDs ready BEFORE you plan to file!

- If you have filed a FAFSA before, you have an FSA ID. If it is your first time filing a FAFSA, you will need to create an account and get your FSA ID.

- If parents file their taxes separately, they both need an FSA ID. If they file taxes jointly, they only need one FSA ID.

- Important: You will not be able to apply for an FSA ID and file your FAFSA in the same day, as the FSA ID processing and retrieval can take up to 3 days.

- If you don’t have an FSA ID, or can’t remember it, please visit the Federal Student Aid Website.

IN-STATE STUDENTS: Please mark UT Knoxville as the first choice for the HOPE Scholarship in the TSAC portal to receive the most accurate estimate of state financial aid (HOPE, GAMS, etc.).

FAFSA Events & Support

April 3 Zoom Webinar | We hosted a FAFSA webinar on April 3 from 6-7:00 p.m. EST. The webinar provided students and families with their FAFSA next steps and answered any questions they had. Watch the recording here.

File on Fridays | We’re here to support you as you file the FAFSA! For in-person filing help and a sweet treat, drop in for “File on Fridays” at the Center for Financial Wellness (CFW) in Hodges Library on Fridays from January 26 through April 19 from 11 a.m. to 4 p.m.

Facebook Live | We held a FAFSA Facebook Live event on the UT Knoxville Facebook page! Our financial aid and FAFSA experts answered student and family FAFSA questions. Click the button below to watch the recording.

“Meet the Counselors” Event | Students who attended enjoyed a free lunch and were eligible to win prizes during “Meet the Counselors” on February 15 at the Center for Financial Wellness (CFW) and One Stop on the ground floor of Hodges Library. Attendees received the FAFSA and financial aid support they needed, or connected in-person with a One Stop or CFW team member!

Filing the FAFSA

- Have your FSA ID ready.

- Visit the Federal Student Aid FAFSA website to start filing your FAFSA.

- Use UT’s federal school code – 003530, when you file.

- File by the UT FAFSA Priority Date of March 15, 2024.

The UT FAFSA Priority Filing Date of March 15, 2024, is the date we encourage you to have your FAFSA filed by to be eligible for the majority of the different types of aid. If you missed this date, there is still time to file!

Starting with the 2024-2025 FAFSA, more students will be eligible for Pell grants than ever before! Pell is calculated based on your Student Aid Index (SAI). Your SAI measures your parents income, your family size, how much you may be able to pay, and how much you need. Make sure you file your FAFSA to find out if you are Pell eligible!

The new FAFSA makes filing easier than ever! FAFSA filing errors were common, due to the amount of information the FAFSA gathered, including tax info. Errors meant that students had to fix information and could not be provided with the correct estimated financial aid amount. The new FAFSA automatically pulls in income tax information, making user errors less likely, and helping ensure the information is correct. This step requires consent from both the student and parent. Consent is just giving permission for your IRS data to automatically link to your form.

If your parents are separated or divorced, the parent or guardian that provides the most financial support to you will file. If your parents/guardians file their income tax together, it doesn’t matter which files. Once you begin filing, the FAFSA has a “Parent Wizard” tool to help you figure out which parent/guardian needs to file with you.

UT should start getting FAFSA information from the U.S. Department of Education later this spring. Students who’ve filed will receive an email confirming their submission and can check their status from the “My Activity” page after logging in to StudentAid.gov. Don’t worry if you see “in review” for your status, your application has been submitted and is in the review process.

UT should start getting FAFSA information from the U.S. Department of Education later this spring. Financial aid eligibility and offers will be processed soon after receiving this information. You will receive an email from UT when your offer is available.

The New, Better FAFSA is:

- Shorter

- Less questions for students and parents/guardians to answer

- Easier to file

- Automatic income tax data import will improve filing accuracy and mean less manual work and errors for students and parents/guardians

- Opening later

- This year’s FAFSA (for the 2024-2025 academic year) opened in December of 2023. The FAFSA should resume a normal opening date of October 1 in 2024.

Don’t Forget!

UT students need to complete their FAFSA every year to apply for or remain eligible for most types of aid, including grants, need-based scholarships, Federal Work-Study, the HOPE scholarship, loans, and more!